Policy response

1. To reach the 2050 objectives, governments and the private sector especially in the United States will need to invest at least 7 to 8 trillion dollars just in infrastructure as we fundamentally rethink how we operate our global economy. This means encouraging investors such as asset managers into long-term funding.

2. Global tourism and exports from Emerging Markets are likely to fall as they internalize the climate costs, though as Emerging Markets likely become cheaper through devaluations, it may simply mean longer delays in delivery as we find more carbon-efficient way to transport cargoes. Flowers from Kenya or Green Beans flown in from Cameroon are likely to disappear.

3. As the many compete for a slowing path of economic opportunities, the pace of shareholder activism on ESG and political pressure is likely to ebb in recessions/instability and accelerate (with a lag) in expansions. This means that we are probably set to miss the 2050 objectives led most likely by parts of emerging markets falling far behind the curve. Some parts of Emerging Markets are sensitive to populism where pandering to a peculiar group for short-term political gains outweighs long-term structural concerns – the same can be found in developed economies but the mechanism there is generally weaker. That suggests a rise in climate trade barriers over the coming decades and a rejigging of the supply chains, aligned in part on political blocks. This will most likely make supply chains less cost effective.

4. Faced with a more uncertain future and very easy monetary conditions leading to likely far more expensive real estate, household formation and births are likely to slow down significantly, affecting global growth and emissions.

5. By definition, the nature of complex systems and unintended consequences means that they are not fully predictable. Hence, we can only have an idea as to how the policy responses affect the economy and politics as our empirical models are woefully inadequate, offering only the illusion of certainty.

Necessity is the mother of invention

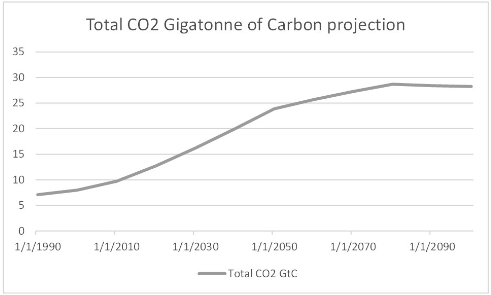

The global economy is suffering a steady and persistent shock on its capital and path of expansion from climate change leading to a slow erosion of the world’s capital/quality, sudden severe weather events and the feedback loop of measures to internalize climate costs. Necessity though is the mother of invention with farms adapting to new crops and ESG investment flows encouraging steady incremental – and over time more frequent but rare structural – breakthroughs helped by government incentives and the necessities of climate change. Over a long period of time, innovation is likely to outweigh slower population growth and the costs of climate change.

Market impact

What we are faced with is a fundamental transformation of our economy and capital stock over the coming decades led by ESG with structural breakthroughs ever more likely to create a new ecosystem of dominating companies in high value sectors. The likes of old kings such as Apple are likely to adapt rapidly to this new emerging ecology paradigm with its ecology/tree of connected innovations. Older companies unable to adapt due to higher funding costs are probably set to steadily leave the scene. In fixed income, one can easily imagine that central banks will funnel ever more funding towards ESG when they can and that term structures in developed markets should stay flat driven by excess liquidity and moderate growth expectations.

Conclusion

We are in the early process of the deployment of ESG capital which will fundamentally change our economy. In this world, the analysis of companies will be fundamental as it should build the list of emergent companies and those existing that will adapt well and flourish under the new paradigm of climate change which is a secular force in the coming decades.

While we have a large dedicated Responsible Investment team, soon to be expanded to an ESG hub in Singapore, one should note that ESG research is also available to the public and its clients from our investment bank. For example, see the publication “How climate change affects returns on investments”

https://www.nordea.com/en/doc/how-climate-change-affects-return-on-your-investmentsoct-2021.pdf

Source: Nordea Bank Abp